Muse Communications Tracks Data, Market Trends to Help Law Firms Stay Ahead

At Muse Communications, we’re always looking ahead to anticipate how our services can provide value.

One of the ways we do that is by keeping an eye on the broader business landscape. We put on our news reporter caps and find data and details that show where the legal industry might be headed.

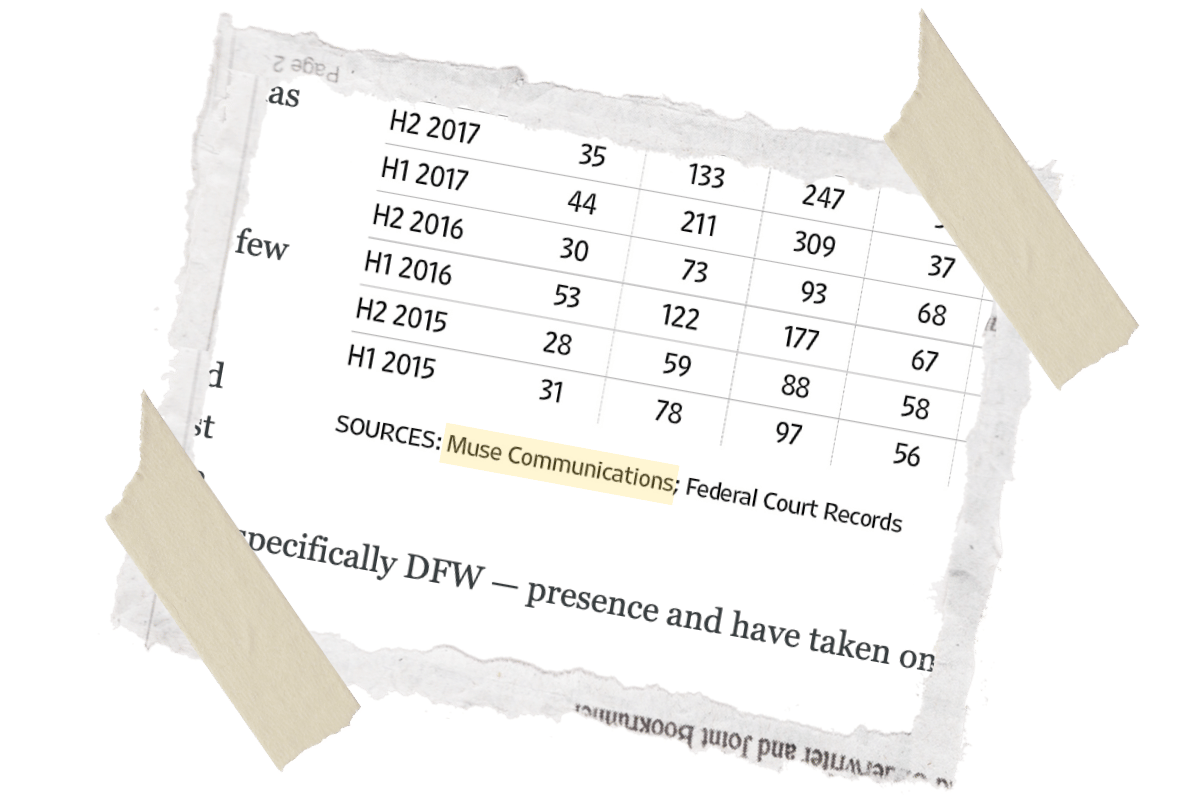

Case in point, our team recently crunched federal court records at midyear to reveal some valuable trends in Chapter 11 commercial bankruptcy filings. Our research confirmed that filings are up broadly in venues that traditionally handle complex bankruptcy filings: Delaware, the Southern District of New York, and Southern District of New Jersey, as well as the Southern District of Texas and the Northern District of Texas.

Muse Communications was named one of

Texas’ best legal public relations firms by the readers of Texas Lawyer.

Need help turning your legal marketing to-do list into reality? Just drop us a line.

Notably, for the first time, commercial bankruptcy filings in the Northern District of Texas exceeded activity in the Southern District of Texas, which has struggled since U.S. District Court Judge David Brown resigned amid outcry over an undisclosed relationship with an attorney who frequently appeared in his court.

A subsequent in-depth article by The Texas Lawbook took a deeper dive, talking with bankruptcy lawyers on the ground, who confirmed that what they’re seeing is in line with the data. Bankruptcy practice groups are busy, and law firms are jostling to be ready to handle what they expect to be increasing numbers in the months ahead.

Writes The Texas Lawbook:

622 companies and their affiliated businesses sought protection to restructure under Chapter 11 in the Texas bankruptcy courts between Jan. 1 and June 30 — more than any other state by a large margin.

The Northern District of Texas, which includes Dallas and Fort Worth, recorded 256 new business bankruptcies during H1 — a 64 percent jump from the same period one year ago and more than any previous year on record.

Restructuring attorneys on the ground in Texas provided insight into the Muse research.

“If a recession arrives in the fourth quarter of 2025, we expect all bankruptcy courts will see an increased number of cases,” Haynes Boone bankruptcy partner Charles Beckham told Lawbook. “The end to the trillions in federal fiscal stimulus certainly impacted a cross section of industries, but consumer spending was the hardest hit.”

That being said, O’Melveny & Myers bankruptcy partner Lou Strubeck noted that DFW and Houston attract different types of bankruptcy cases.

“Healthcare companies made billion-dollar decisions years ago, based on what they perceived to be a reliable payment scenario. Those decisions have been thrown into chaos. Chaos causes business distress,” he said. “The volatile tariff situation is also causing distress for businesses that rely upon imported goods. Some companies will thrive, and some companies will suffer significant distress.”

Are you seeing trends in your practice that gives insight into the broader economy, or even contradicts conventional economic wisdom? Let us know. Together, we can turn that into a meaty pitch to a trusted reporter.

Robert has decades of PR and marketing know-how. From big firms to startups, he dives deep into each client’s business to craft authentic stories. When he's not helping clients, you might find him cursing while renovating a vintage Airstream.

He can be reached at robert.tharp@muselegalpr.com or

214-458-4007.